You May Be an Heir to an Estate in France

In the event of the death of a person in France, or whose succession is governed by French law, the succession opens on the day of death.

A notaire, a public officer appointed by the French Minister of Justice and entrusted by the State with mission of public service, will be responsible for its settlement.

When the heirs are unknown, the notaire uses a genealogist. If we contact you, it is because you are a potential heir in an estate opened in France.

Our tasks

Our first task is to search for the heirs.

The second is to represent them and ensure that their rights are defended to the best of our ability, to resolve specific difficulties in their case and to act on their behalf.

This is particularly useful when there’s is a large number of heirs, they live abroad and are not familiar with French procedures or the language.

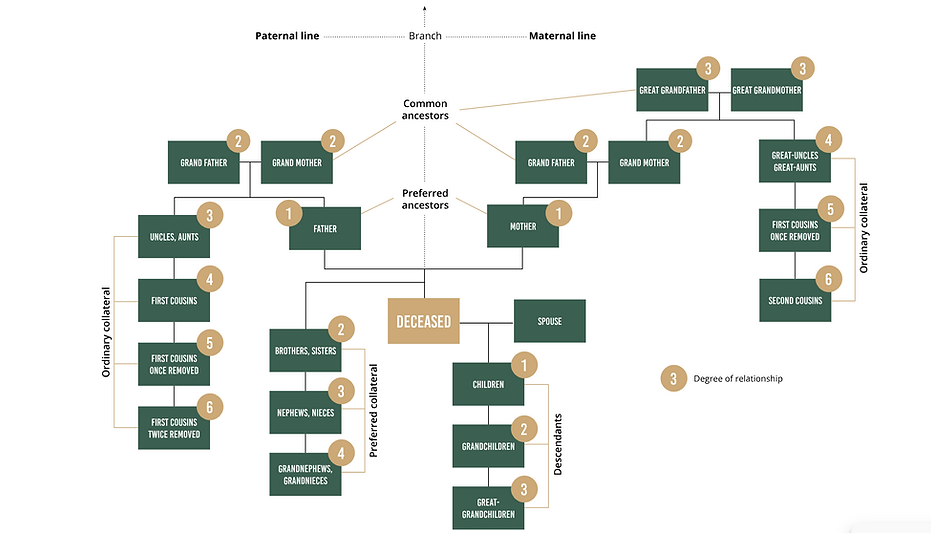

Presentation of rules of inheritance under French law

French law classifies heirs into 4 orders:

-

Order of descendants: children and their descendants.

-

The order of privileged ascendants and collaterals: father, mother, brothers, sisters and their descendants.

-

Ordinary ascendants: ascendants other than parents.

-

Ordinary collaterals: uncles, aunts, first cousins, distant relatives.

The services we offer

Our contract, our commitments

The Coutot-Roehrig law firm is authorized to establish the origin of your inheritance rights, provide legal assistance, and represent you throughout the entire estate settlement process. It handles all the necessary procedures for the opening, processing, and settlement of the estate, both in France and abroad.

In accordance with contractual stipulations, fees are only payable if the outcome of the estate is favorable to the identified heir. Failing this, particularly in the event of inheritance liabilities exceeding the net assets transferred, all costs incurred for the assignment are fully assumed by their firm, without recourse against the heir.

Fees are based on the heir's net share, after deduction of inheritance tax and all costs related to the settlement process. This percentage is determined according to the degree of relationship to the deceased and the size of the estate.

The heir thus represented benefits from a total exemption from liability for acts performed within the framework of the mission. In addition, our partner ensures the filing of mandatory tax returns relating to the estate.

HOW AN ESTATE IS SETTLED IN FRANCE

Beginning of the probate process

Under French law, the notaire is in charge of the estate settlement. The notaire is appointed by the Minister of Justice and entrusted by the State with mission of public service.

Mandate in favour of the probate researcher

The notaire may refer to our company in order to identify and locate the heirs of the deceased pursuant to Article 36 of the law 2006-728 of June 23, 2006.

Searching for and legally representing heirs

Our company will make exhaustive searches that can take time to be completed. International cases can make an impact on the processing time of the file. At times, duration remains unpredictable.

Establishing evidence of heir’s legal entitlement to the inheritance

Once we have collected the required paperwork, we can transfer to the notaire in charge of the settlement who will draw up the deed of notoriety.

Settlement process of the estate

The French notaire acts in the best interest of the heirs dealing with the administrative part of the estate and paying any bills due.

Submission of the declaration of inheritance

The submission of the declaration of inheritance lists all the elements of the estate. It is compulsory and sent to the tax authorities to get the amount of the inheritance taxes due to the French State.

Settlement process of the estate

For any real estate to be distributed, we get estimates from experts in order to sell to the best value for the heirs, and upon their agreement.

Submission of the declaration of inheritance

The heir receives a net share once inheritance taxes and our fees are taken out.